203k Mortgage Rates

Let's Talk About Renovation Lending Options

Talk with a licensed renovation lender to see what your scenario or property may be eligible for.

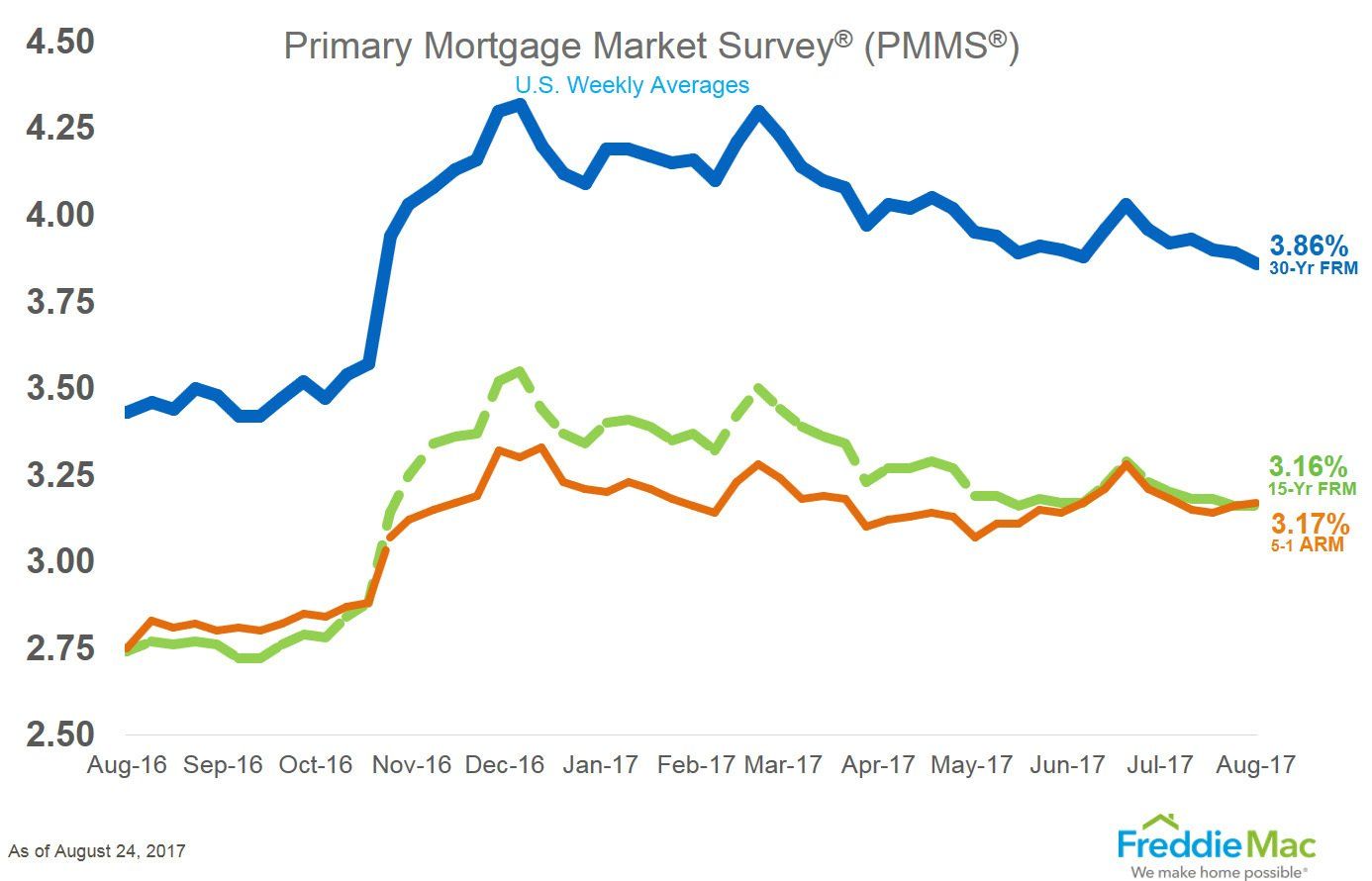

How To Find Today’s Best Interest Rate For A Renovation Loan

The secret to finding the best rate is to shop for the right lender based on their rate lock policy and knowledge of what market conditions will be impacting rates in the near future.

When shopping for the best interest rate on your home improvement loan, it is important to remember that mortgage rates may tick up or down throughout the day due to many economic and market related factors that are beyond your control.

Shop The Lender, Not The Rate

Having a better understanding of how lenders pay attention to the market and rates for their borrowers is critical for getting the best mortgage rate on an FHA 203k loan or other renovation program, especially if you are getting alternative rate quotes on different times and days from a handful of banks.

If the lenders you are shopping for rates know how to answer the following questions without hesitation, you should feel confident that they have the experience, technology and company support to help you lock the best rate for your scenario.

How Do I Guarantee That I Get The Rate I Want?

In most circumstances, lenders will require a full underwritten approval before a borrower can lock in an interest rate.

Keep in mind that the longer the lock period is (15, 20, 30, 45, 60 days), the higher the interest rate will be. So, it’s actually beneficial to wait until your file is fully approved and ready for loan documents.

Renovation loans may take a few extra weeks or months to fully fund, depending on the scope of work or type of property you are looking for. Stay in close communication with your lender about market movements that could impact rate and purchasing power due to a change in Debt-to-Income Ratio.

What Is The Difference Between Note Rate And APR?

When shopping for a new mortgage loan, you may notice an Annual Percentage Rate (APR) advertised next to the note rate. The inclusion of an APR is actually mandated by federal law in order to help give borrowers a standard rule of measurement for comparing the total cost of each loan.

The APR represents a true cost of a loan to the borrower, expressed in the form of a yearly rate. This prevents lenders from hiding fees and loan rate costs behind lower advertised rates.

According to Wikipedia, the term “Annual Percentage Rate (APR) and nominal APR describe the interest rate for the whole year (annualized), rather than just a month's fee/rate, as applied on a loan, mortgage, credit card… It is basically a finance charge expressed as a rate.

The nominal APR is the simple-interest rate (for a year). The effective APR is the fee compound interest rate (calculated across a year).

The nominal APR is calculated as: the rate, for a payment period, multiplied by the number of payment periods in a year.

However, the exact legal definition of an effective ARP can vary greatly, depending on the type of fees included, such as participation fees, loan origination fees, monthly service charges, or late fees.

The effective APR has been called the mathematically-true interest rate for each year. The computation for the effective APR, as the fee+compound interest rate, can also vary depending on whether the up-front fees, such as origination or participation fees, are added to the entire amount, or treated as a short-term loan due in the first payment.

Fees that are calculate in the APR include:

Origination Fee, Discount Points, Prepaid Mortgage Interest, Mortgage Insurance Premiums and other lender fees (application, underwriting, tax service, etc.)

Fees such as title insurance, appraisal and credit are not included in calculating the APR.

The APR can vary between lenders and programs due to the fact that the federal law does not clearly define specifically what goes into the calculation.

One thing to keep in mind is that 15-year term will have a higher APR simply because the fees are amortized over a shorter period of time compared to a similar rate & cost scenario on a 30-year term.

What Factors Influence Mortgage-Backed Securities?

1) Inflation

In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time. When the price level rises, each unit of currency buys fewer goods and services; consequently, annual inflation is also an erosion in the purchasing power of money a loss of real value in the internal medium of exchange and unit of account in the economy.

As inflation increases, or as the expectation of future inflation increases, rates will push higher. The contrary is also true; when inflation declines, mortgage rates decrease.

2) The Federal Reserve

As part of its 2008-2010 stimulus effort, the NY Fed spent almost all of its $1.25 TN budget buying mortgage bonds. Many believe this strategy kept mortgage rates lower over a 15 month period.

The meltdown in the mortgage market and world economies lead many investors to shy away from the risks associated with MBS, which is why the Fed had to step in and basically assume the role as the sole investor of mortgage bonds.

3) Unemployment

Decreasing unemployment will suggest that mortgage rates will rise. Typically, higher unemployment levels tend to result in lower inflation, which makes bonds safer and permits higher bond prices.

Higher bond prices will push mortgage interest rates up.

4) GDP

GDP, or Gross Domestic Product, is a measure of the economic output of the country. High levels of GDP growth may signal increasing mortgage rates. The Federal Reserve slashes short-term rates when GDP slows to encourage people and business to borrow money. When GDP gets too hot, there might be too much money floating around, and inflation usually picks up.

5) Geopolitics

Unforeseen events related to global conflict, political events, and natural disasters will tend to lower mortgage relates. Anything that the markets didn’t see coming causes uncertainty and panic. And when markets panic, money generally moves to stable investments (bonds), which brings rates lower.

Mortgage bonds pick up some of that momentum. Economic data is reported daily, and some items have a greater tendency to be of concern to the market for mortgage rates.

How Are Mortgage Rates Determined?

Many people believe that interest rates are set by lenders, but the reality is that mortgage rates are largely determined by what is known as the Secondary Market. The secondary market is comprised of investors who buy the loans made by banks, brokers, lenders, etc. and then either hold them for their earnings, or bundle them and sell them to other investors.

When the secondary market sells the bundles of mortgages, there are end investors who are willing to pay a certain price for those loans. That market price of those Mortgage Backed Securities (MBS) is what impacts mortgage rates.

Typically, investors are willing to accept a lower return on mortgage-backed securities because of their relative safety compared to other investments. This perception of safety is due to the implied government backing of Fannie Mae and Freddie Mac and the fact that the Mortgage-Backed investments are based on real estate collateral.

Why Do Mortgage Rates Change?

Mortgage rates fluctuate based on the market’s perception of the economy. Stocks are considered riskier investments and therefore have an expected higher rate of return to compensate for that risk.

When the economy is thriving, it is presumed that companies will perform better, and therefore their stock prices will move higher. When stock prices move higher MBS prices generally move lower. Mortgage-Backed Securities, however, thrive when the economy is perceived as not doing well.

When investors forecast a faltering economy, they worry that the return on stocks will be lower, so they frequently engage in a flight to safety and buy more secure investments such as Mortgage Backed Securities. Mortgage rates are actually based on the yield of those Mortgage Backed Securities.

Bonds are sold at a particular price based on their value in relation to other available investments.

When a bond is sold it yields a certain return based on that original purchase price. As the prices of the MBS increases because investors seek their safety, the yield decreases.

Conversely, when investors seek the higher returns of stocks and the MBS are purchased in lesser quantities the price goes down. The lower price results in a higher yield, and this yield is what determines mortgage rates.

How Will I Know If Rates Will Go Up Or Down?

Up

When the economy is growing or is expected to grow, stocks will likely become the more favored investment. When investors buy more stocks, they purchase fewer MBS, which drives the price down.

When the price of the MBS is lower, the yield increases. Since mortgage rates are based on the yield of the 30 Year MBS, you would expect rates to increase in this environment.

Down

When the economy appears to be slowing or is doing poorly, investors typically move their money out of the stock market and into the safety of the MBS. This drives the price of these investments higher, which results in a lower yield.

Since mortgage rates are based on the yield of the 30 Year MBS, you would expect rates to decrease in this environment.

Who Determines Rates, And What Are They Tied To?

Mortgage interest rates are determined by the pricing of Mortgage-Backed Securities or Mortgage Bonds. The media often implies mortgage rates are based off the 10-year Treasury Note, which is incorrect.

While the 10-year Treasury Note has been known to trend in the same direction as Mortgage Bonds, it is not unusual to see them move in completely opposite directions.

How Often Do Mortgage Rates Change?

Mortgage rates may change throughout the day, however, they only change on days when the Bond markets are trading securities since mortgage rates are based on Mortgage Bond prices. Think of a Mortgage Bond’s sales price similar to that of a Stock that trades up and down during the course of a day.

For example, let’s s assume the FNMA 30-Year 4.50% coupon is selling for $100.50. The price is 50 basis points lower from the previous day’s closing price of $101.00. In simple terms, the borrower would have to pay an additional .50% of their loan amount to have the same rate today that they could have locked in the previous day.

Mortgage Bonds are largely affected by various market forces that influence the changing demand for bonds within the market. Some of the key economic factors that have the greatest impact are unemployment percentages, inflationary fears, economic strength and the overall movement of money in and out of the markets.

Like stocks, most fluctuation is caused by consumer and investor emotions.

When The Fed Lowers Rates, Why Do Mortgage Rates Increase?

It is a common misconception that when the Federal Reserve implements a rate cut it is immediately correlated to a reduction in mortgage rates. The Federal Reserve policy influences short term rates known as the Fed Funds Rate (FFR).

Lowering the FFR helps to stimulate the economy and increasing the FFR helps to slow the economy down. Effectively, cutting interest rates (FFR specifically) will cause the stock market to rally, driving money out of bonds and creating potential for inflation.

Mortgage Bond holders need to obtain a higher rate of return on their money if inflation is increasing, thus driving up mortgage rates. With the Federal Reserve Board meeting every six weeks, this is an important question to ask.

If your lender does not have a firm understanding of this relationship, they may leave your rate unprotected costing you thousands of dollars over the life of your mortgage.

Why Do Mortgage Rates Differ Between Owner Occupied, Investment & Second Homes?

Mortgage interest rates are based on risk-based pricing. Risk-based pricing allows adjustments to par pricing for risk factors such as FICO scores, Loan-to-Value percentages, property type (SFR, Condo, 2-4 Units), occupancy (Primary, Vacation or Investment) and mortgage type (Interest Only, Adjustable Rate etc.).

This allows the investors who lend their money for mortgages to receive additional compensation for taking additional risk. If the borrower encounters a financial hardship, are they more likely to make the payment on the home they live in or the one they rent out.

What Do You Use to Monitor Mortgage Rates?

There are several great subscription-based services available to monitor Mortgage Bond pricing. The key is to make sure the lender is aware they should be monitoring Mortgage Bond pricing, such as the Fannie Mae 30-Year 4.50% coupon and not the 10-Year Treasury Note or the news media.

Experienced mortgage professionals have a number of mortgage rate tracking tools and alert systems in place to notify them via email and even text message when the market shifts one way or the other.

Even a small move by .125% can make a significant difference if a lender has 100+ loans in floating status, so seasoned mortgage professionals obviously take this rate game seriously.