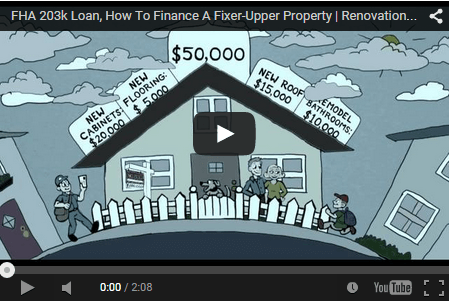

FHA 203k Full Renovation Loan

The Standard 203k was created specifically for projects that warrant extensive work or repairs, projects that will take longer than six months to complete, or when rehab costs will exceed $35,000. Additionally, Standard 203k loans have no maximum repair amount.

The Standard (k) loan option must be used when a property requires (or the borrower requests) structural work, such as a room addition or the removal or relocation of an interior or exterior wall.

Let's Talk About Renovation Lending Options

See which Renovation Mortgage Program your scenario or property may be eligible for.

203k Loans

Basics Of A Full FHA 203k Rehab Loan

A Standard 203k is also used if the project requires engineering or exterior grading or inspections. The Standard 203k must be used if the renovation work will prohibit the homeowner from occupying the residence during the process.

If the home is considered uninhabitable, up to six months of mortgage payments can be financed to cover monthly loan payments during the renovation process and help the homeowner pay for alternate housing during construction.

On a Standard 203k loan, FHA requires that a FHA-designated Consultant create and document a work plan before they will approve the loan.

The maximum mortgage amount allowed for a standard 203k is based on whichever is less:

- The as-is value of the property plus the costs of repair and rehabilitation.

- 110% of the projected value of the renovated property.

All 203k programs allow borrowers to finance the purchase price of the property, the closing costs, plus the cost of repairs.

Did You Know?

A rehab loan can be used for a purchase or refinance, and you do not have to be a first-time homebuyer to use it. Contact Us today at to see how a 203k loan can increase the value of your property.